Title financial loans can be a sort of brief-time period personal loan usually repaid within just 15 to 30 days just after receiving the funds. Like payday loans, they usually don’t have to have credit score checks.

Most borrowers look for out these loans for swift entry to dollars — which numerous lenders can deposit straight into your account within just a person company working day of acceptance soon after verifying your earnings and credit score rating.

Think about starting up or beefing up your unexpected emergency financial savings fund to prevent borrowing for sudden challenges in the future.

Activated, personalised debit card required to come up with a bank transfer. Boundaries implement to lender transfers. Matter for your bank’s limitations and fees.

Early deposit would not apply to Inexperienced Dot accounts opened in a tax Experienced’s office. The title and Social Security number on file Together with the IRS should match your account to avoid fraud limits on the account.

Clearance times are subject matter in your bank. Based upon your financial institution, you may well be paid inside minutes of confirming your personal loan seven times every week, such as general public holidays.

Exclusive options: Preserve an eye out for perks supplied by lenders, like fascination fee savings, unemployment defense and on the web monetary applications.

S. Older people have no crisis financial savings as of May well 2024. Think about automating your price savings, even though it's a little total, to create a fund to pay for money for your unanticipated in lieu of racking up interest fees with the unexpected emergency bank loan.

Your charge card business may well lengthen you a more info short-expression bank loan in the form of a hard cash advance. Such a personal loan is probably the fastest tips on how to entry money since you have the hard cash from a bank card you have already got.

Cons You may have to pay for a higher curiosity rate, which can boost the All round cost of Everything you're fixing.

Overview: Prosper is a private financial loan pioneer — the corporate became the main agency to enter the peer-to-peer lending arena when it launched in 2005.

Credit score unions. Final, you might be able to borrow crisis money from an area credit history union. But be aware the timeline is generally extended than an internet lender. You might also should be a member in superior standing to receive a personal loan, especially if you have a reduced credit score score.

Bankrate’s staff of industry experts makes use of a 20-position program to select the lenders which offer the ideal unexpected emergency bank loan premiums.

It's supplied a lifeline for children from deprived communities for one hundred twenty yearsCredit: Males Media

Haley Joel Osment Then & Now!

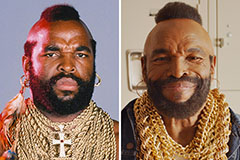

Haley Joel Osment Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now!